Roth Vs. Traditional TSP Contributions

The Thrift Savings Plan (TSP) is an incredible retirement savings tool offered to Federal Employees. However, most people don’t use it to its full potential.

When setting up their TSP contributions, most people will focus only on how much to contribute and which funds to invest in. While these are two very important components, there’s another decision that needs to be made in order to take full advantage of the plan.

The TSP offers two options for contributions: the traditional TSP and the Roth TSP. Each has different benefits and drawbacks, and it’s important to understand the differences before deciding which one to contribute to. Choosing the correct type of account for your situation can equate to thousands of dollars in tax savings down the road.

The traditional TSP allows you to contribute pre-tax dollars, meaning you will not be taxed on your contributions when you make them. This can result in a lower income tax bill for the current year. However, you will be taxed on your contributions when you withdraw them during retirement.

The Roth TSP allows you to contribute after-tax dollars, meaning you will be taxed on your contributions when you make them. However, when you withdraw your contributions during retirement, they will be tax-free. This can be beneficial if you anticipate your tax rate to be higher in retirement than it is now.

But how do you know which one is the best fit right now? It all comes down to your tax rate now, and your tax rate in retirement.

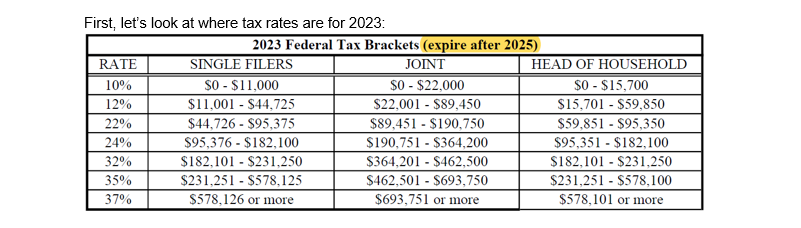

You’ll notice that in the heading of that chart, we have “Expires after 2025” highlighted. Here’s the reason:

Back in 2018, the administration adjusted the tax brackets and ultimately moved them lower. However, they only put this in place for eight years, and unless Congress gets together and votes to lock them in, they’ll automatically sunset in 2026 and go back to where they were pre-2018.

Here’s what they are expected to look like in 2026:

There are a couple of things to notice here.

First, the 22% and 24% brackets (where most of our clients reside) are increased and become the 25% and 28% brackets. Also, instead of the 33% bracket starting at $364k (joint), it begins at $233k, making it much easier to enter a 33%+ bracket.

So what does all of this mean?

Well, for starters, we have a window right now where we can choose to pay taxes at a lower rate than we will likely be paying in 2026. For that reason, we’re encouraging a lot of people to do Roth Contributions and Conversions in the next three years.

But that doesn’t mean it’s the right fit for everyone. Let’s look at a couple scenarios.

Scenario 1:

First, imagine there’s a single filer who makes a taxable income of $200,000. However, this person lives frugally, and in retirement, they don’t see themselves spending over $7,000 per month.

Between their pension and Social Security, they may be set to bring in $6,000/m. That would equate to $72,000. Then they may need another $1,000/m or $12,000/yr from their TSP to cover the remainder of their expenses.

Ultimately, that puts their income somewhere around $84,000 in retirement.

From a tax perspective, their $200k in current taxable income lands them in the 32% tax bracket. In retirement - even in the increased tax environment in 2026 - the $84k of income would put them in the 25% bracket.

In other words, if they were to do Roth contributions now and pay taxes at their current rate, they’d be paying 32% on that money. If they did traditional contributions and waited until they withdrew the money to pay the tax, they would be paying 25%.

In this instance, it makes a lot more sense for the person to do Traditional contributions now and take the tax deduction while their income is high.

Scenario 2:

Next, let’s look at someone who is expecting their current income and retirement spending to be more similar.

Let’s say there’s a married couple that makes $180,000 in combined taxable income, and they’re planning on spending around $120,000/yr in retirement.

Right now they’re paying taxes in the 22% bracket. In retirement (after 2025), their $120k in spending will likely put them in the 25% bracket. And when they start taking RMDs, there’s a good chance it could bump them up into the 28% bracket.

In this case, it would make a lot of sense to pay the tax now and contribute to the Roth side of the TSP.

Now, it’s important to acknowledge that we’re making some assumptions here about the future tax environment. However, even if things don’t go exactly as we have them spelled out here, we should know that we’re in a historically low tax environment.

If you think that your income in retirement will be similar or higher than it is now, Roth contributions are likely a good idea.

If your income now is substantially higher than it will be in retirement, contributing to the traditional side of the TSP may make more sense.

Either way, take some time to think about the implications of your choice. And if you need help making the decision, we’d love to give you our input.

Go to https://www.capitalfinancialplanners.com/register to book your complimentary call.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual.

Investing involves risk including loss of principal. No strategy assures success or protects against loss.

This information is not intended to be a substitute for individualized tax advice. We suggest that you discuss your specific tax situation with a qualified tax advisor.