How tariffs and inflation may affect your TSP.

To say this year has started off with a bang is an understatement. Every day we wake up to headlines about evolving trade negotiations, the federal workforce shakeup and the potential impact on the economy that these could have. As easy as it could be to respond emotionally and throw your entire Thrift Savings Plan in the G Fund, let's break down the complex relationship between tariffs and inflation, and make a rational decision about the impact they should have on our investment strategies.

Understanding today's market environment

The current economic landscape can feel overwhelming, with constant headlines about market volatility, inflation concerns and changing trade policies. At this point, it’s difficult to gauge whether recent proposals, such as tariffs on Mexico and Canada, are just negotiation tactics, or if they’re long-term policies.

Either way, they’re impacting the market. But tariffs are far from the only contributing factor. Before diving into the specific impact of tariffs, let’s explore a few other key factors affecting your investments:

Market concentration risk

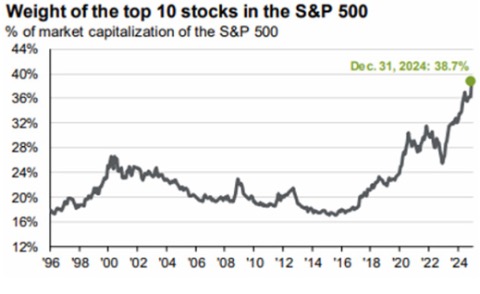

The S&P 500 (tracked by the TSP's C Fund) currently has about 40% of its value concentrated in just ten companies, primarily high-growth technology firms like NVIDIA and Tesla. While these companies have performed well, this concentration creates potential risks for your retirement savings.

Source: JPMorgan Guide to the Markets

This market structure is different from historical norms, requiring a thoughtful approach to managing your TSP and other investments to ensure proper diversification.

Interest rates and investment performance

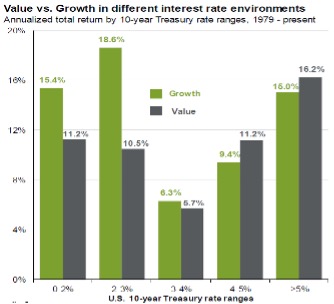

With 10-year Treasury rates around 4.5%, historical data shows that value stocks (companies trading at reasonable prices relative to their earnings) tend to outperform high-growth stocks.

From 1979 to present, whenever interest rates have been between 4-5%, value-oriented investments consistently delivered better returns than growth stocks.

On the more conservative end of the spectrum, bonds (like the F fund) historically perform very poorly in times of rising interest rates, but perform better than short term treasuries (like the G Fund) when interest rates stabilize or begin decreasing.

The real impact of tariffs and inflation

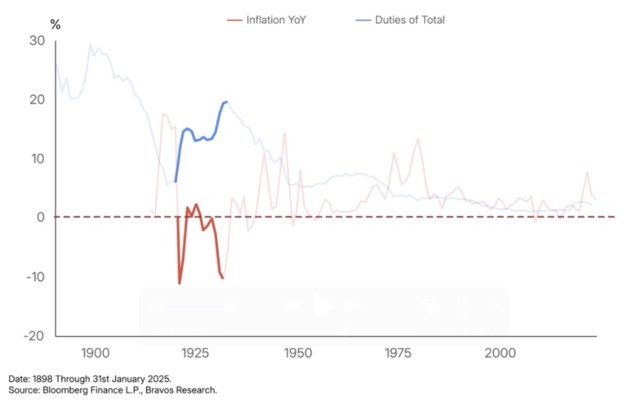

While tariffs could exacerbate inflation if combined with other factors (like stimulus spending or interest rate changes), they are not expected to trigger a significant inflationary surge on their own. Let's separate fact from fiction regarding tariffs and inflation:

Historical perspective on tariffs

During the 2018-2020 period, when significant tariffs were implemented, their impact on inflation was relatively modest.

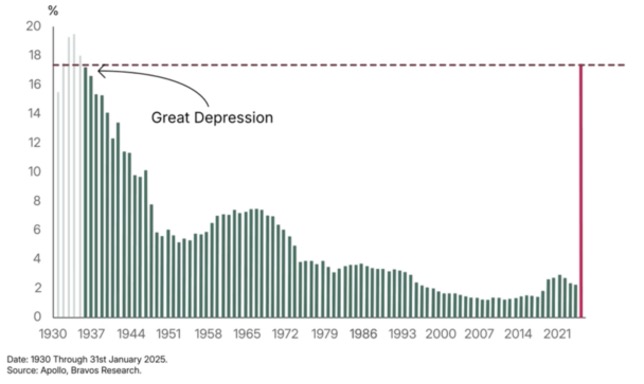

Even in the 1920s, when tariffs represented about 20% of federal tax revenue, there wasn't strong evidence linking tariffs directly to inflation.

What really drives inflation

The most significant inflationary periods in U.S. history were tied to specific events, like post-World War II economic adjustments in the 1940s and the oil crisis of the 1970s.

The 2022 inflation surge was primarily driven by pandemic-related factors, including emergency interest rate cuts and increased money supply, rather than trade policies.

Considerations for your TSP and other investments

Based on current market conditions and historical patterns, here are practical steps to consider for your investment strategy:

Portfolio diversification

While it's tempting to concentrate investments in well-known tech companies or throw everything in the S&P 500 (C Fund) when things are going well, consider broadening your exposure. Unfortunately, the TSP doesn’t have “growth” and “value” funds to choose from, but if you have investments outside of the TSP, you’ll be able to find those.

Including small-cap funds (like the S Fund) and potentially international exposure will add extra layers of diversification, but we need to acknowledge that both of these sectors have a tendency to be volatile in the short-run.

Bond strategy optimization

Instead of avoiding bonds altogether or only using guaranteed-rate funds like the G fund, consider more broad bond exposure as interest rates stabilize and potentially come down.

These can provide stability during market volatility while offering reasonable returns in the current rate environment.

Investments outside of the TSP

The TSP is an incredible vehicle for long-term growth, but unfortunately, the limited investment options available make broad diversification a bit challenging. If you are over 59.5 or are separated from service, you have the option to do a tax-free rollover from the TSP into an IRA, where you would have thousands of investment options available to you. Of course, before doing this, be honest with yourself and decide if having all of those investment options will benefit you or cause you “paralysis by analysis”.

Building a resilient investment approach

Remember these key principles as you adjust your investment strategy:

Market conditions are cyclical. Strategies that worked during near-zero interest rates may not be optimal in today's higher-rate environment.

Successful investing isn't about chasing trends or making dramatic changes based on headlines. Focus on thoughtful adjustments that align with current conditions while maintaining your long-term perspective.

The goal isn't to perfectly time market shifts but to build a resilient portfolio that can help you achieve your financial objectives across different market cycles.

Final thoughts from Capital Financial Planners

While no one can predict market movements with certainty, understanding these patterns and dynamics can help you make better investment decisions. Focus on creating a balanced portfolio that aligns with both current market conditions and your long-term financial goals.

Previously published on GovExec.

Neil Cain and Austin Costello are certified financial planners with Capital Financial Planners. If you don’t feel confident in your investment strategy or your ability to keep a level head and would like feedback, register for a complimentary check up. For topics covered in even greater depth, see our YouTube page.

The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. All indices are unmanaged and may not be invested into directly.

Investing involves risk including loss of principal. No strategy assures success or protects against loss. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk.

The economic forecasts set forth in this material may not develop as predicted and there can be no guarantee that strategies promoted will be successful.

Government bonds and Treasury bills are guaranteed by the US government as to the timely payment of principal and interest and, if held to maturity, offer a fixed rate of return and fixed principal value.

Bonds are subject to credit, market, and interest rate risk if sold prior to maturity. Bond values will decline as interest rates rise and bonds are subject to availability and change in price.